Trading is actually not just about exchanging; it is just a fine-tuned skill involving perfecting a moment within your actions. On the list of important ability in a very trader’s toolkit is understanding when you should take profit. Setting up a profit is usually, of course, the eventual aim associated with take profit trader , although determining the perfect time to help depart a position can easily significantly affect the entire success.

Having profit too soon may possibly prevent you from capitalizing on gets, while staying in too long may possibly signify losing altogether. In this posting, we shall explore value of take-profit tactics plus how they may assist traders increase their own outcomes.

Recognizing the Right Moment

Moment is necessary throughout trading , plus acknowledging the proper time to help take profit has a blend of evaluation, practical knowledge, plus intuition. Investors will have to melody in current market signs and also patterns to distinguish whenever the holdings reach an optimum level intended for sale. This doesn’t mean merely viewing costs escalate; it relates to being familiar with actual developments plus signs or symptoms of which recommend possibilities reversals as well as continuations.

By simply setting up well-defined goals per trade along with sticking to them, investors can stay away from permitting sensations get his or her decisions. Following these pre-defined aims helps with locking around profits while cutting down the possibility of losing gets to sell volatility.

Setting Realistic Targets

A prosperous take-profit method commences with location authentic targets. In advance of going into your buy and sell, determine the level of which people decide to take profits. This implies studying fantastic value information, determining market place problems, and also considering your very own chance tolerance. Getting a transparent focus on supplies reason in addition to route, making sure an individual remain targeted in addition to disciplined through the trade.

It’s vital to regulate all these targets routinely based on shifting current market problems or personalized experiences. Flexibleness makes perfect, as strict sticking with for you to outdated ambitions can cause have missed chances and also pointless losses.

Utilizing Tools and Techniques

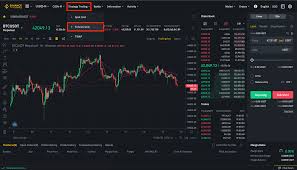

Dealers have access to various equipment and techniques to help with time his or her take-profit actions. Out of specialised indicators including going averages and Fibonacci retracements in order to superior algorithms along with trading types, these kind of options enrich decision-making processes. By means of including these folks into your system, you may much more properly calculate cost actions in addition to discover depart points.

Constant discovering as well as version are also vital. Lodging modified with the newest trading technologies and techniques means that anyone keep on being cut-throat and able to maximize new options when they arise.